Charmaine Lim, Associate

Wills and Probate

Our lawyers have extensive experience in drawing up wills and acting for our client in probate matters, including contested probate applications.

Do I need a will?

The attached video will explain in detail all you need to know about making a will.

Probate

Probate is a critical legal step needed before a person’s estate can be administered or distributed to the beneficiaries. It is a document issued by the court certifying the will is valid. It also confirms the appointment of an executor. There are two main types. Probate and Letters of Administration.

Why is probate needed?

A deceased person cannot continue to hold bank accounts, shares, real property, cash, superannuation or furniture. They can’t be employed or receive pension payments.

- Probate starts the process of winding up all their affairs.

- Probate makes the will legal

The court requires proof that the executor appointed in the will is alive, willing and competent to undertake the tasks involved. It determines the document is the last will made by the deceased. It also verifies that there are no objections to the will.

Why is probate important?

Without probate an executor does not have the authority to administer the estate. Without probate, an executor would not be able to transfer certain assets to beneficiaries.

What if there is no will?

When a person dies without a will, there is no executor appointed to administer the estate. In these cases, the next of kin usually have to apply for a document called ‘Letters of Administration’

What is Letters of Administration?

Letters of Administration is the court’s approval for someone to administer the estate of a person who dies without a will. In most instances this is granted to the next of kin of the deceased. This could be their spouse, their domestic partner or one of their children.

Mark Yeo, Director

Handling of gaining control of the deceased foreign accounts (sept 2020)

Dear Paul,

How are you in this weird Covid time. Nothing is normal, but ETP succeeds in our mission.

Our last correspondence was in July 2019 and if I understand correctly, you have been following the progress in the background.

Last week, the Court finally granted the Letters of Administration.

I’d like to express my gratitude for your continued and invaluable guidance and the reduction in costs that was applied to us. Thank you so much.

We were faced with many obstacles as the process developed, with the issue of the executor and the applicability and interpretation of International law as ultimate lows. Mark Yeo, Justin Lim and ms Goh Siew Tin, the whole team have done a great job supporting me both legally and mentally. ETP has lived up to its motto “Service with the Heart”.

We would like to show our appreciation for ETP’s efforts in our case. However, due to the distance, we were never able to connect with Mark, Justin and ms. Goh Siew Tin. On the level to know their preferences for, for example, food and drinks. Delicacies (mooncakes or….. , alcoholic beverages (whiskey? Wine? Something else)

I can ask my brother Rick to arrange such on our behalf. Please let me know if you have any suggestions.

Warm regards,

Peggy de Haan-Gouw

September 2020

Charmaine Lim, Associate

What is a Will?

A Will is a legal document that takes into effect only upon your death.

Contrary to popular belief, Wills are not only exclusive for the wealthy, but they are for everyone who has assets.

Upon your death, your executors shall bring the original copy of your Will to a lawyer to apply for a Grant of Probate.

Wills are revocable. So do not worry, if circumstances change, you can change your Will so long you have the requisite mental capacity to do so.

Benefits of drafting a Will

There are also many benefits to making a Will:

- To preserve the heritage we own in our lifetime, and to hand them to the rightful successors.

- To express your wishes on how certain properties are to be dealt with where the Intestate Succession Act is insufficient to fulfill such wish.

- To return monies that we have owed to persons who have helped us during difficult times.

- To express any intention to exclude categories of persons to be included in the Will.

The Importance of a Properly Drafted Will

A properly drafted Will will prevent your Estate from encountering complications later on, which could result in higher professional fees and time spent, and potentially impose unnecessary burden on your Executors. The common causes for poorly drafted Wills include:

- clauses that are incomplete;

- ambiguous words/terminologies used; or

- contradicting clauses

Drafting a Will with personalized attention by a qualified professional is very important. Our Wills are crafted by our lawyers, and they are customizable according to your needs and assets. There are certain clauses which clients intend to put in a Will could sometimes result in against the client’s wishes, if not properly advised.

What happens if I do not draft a Will?

Upon your death, the distribution of your Estate will be governed under the application for Grant of Letters of Administration. The assets will be distributed according to the hierarchy set out under the Intestate Succession Act. This means that the distribution of assets may not go according to your specific wishes if you have them.

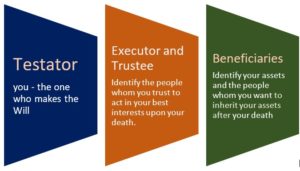

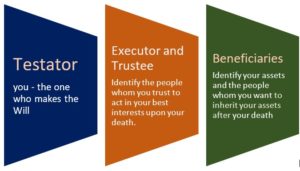

Components of a Will

Wills can be simple (or complex) depending on the number of clauses and situations you wish to provide for. No matter how complex or simple a Will is, making a Will is akin to preparing a dish. There are the basic ingredients which give the Will its structure, and the absence of any of these basic ingredients can result in cost and time complications at the time of execution, or worse still, the Will to be rendered invalid. The key structure in a Will is outlined as follows:

Testator

We will need sufficient information about you. You must not be mentally impaired, and are able to make critical decisions for yourself.

You may seek professional legal advice specifically on the following:

- Can a foreigner draft a Will in Singapore?

- Can I have a joint-will with my spouse?

- Does a person with partial loss of mental capacity be totally precluded from making a Will?

Executor & Trustee

An Executor (Executrix for women), plays an important role in managing the Deceased’s Estate. When appointed, he/she will need to consult a lawyer to obtain a Grant of Probate. He/she is also entrusted to distribute the assets to the beneficiaries in a timely manner. Hence, the Testator will need to entrust these duties to an able and reliable person. It is also possible for the Executor (or Executrix) to be the beneficiary at the same time, and to also hold a position of a Trustee.

A Trustee has distinctly different duties from those of an Executor. Simply put, a trustee holds on trust the Deceased’s Estate for the beneficiaries. For instance, should there be a minor beneficiary named in the Will, then the Trustee will need to perform his duties to hold on trust the assets for the minor beneficiary until he / she becomes of age to own the assets in his/her own name. There are also professional trustees, who can provide such services to perform the role.

You may seek professional legal advice specifically on the following:

- when an independent trustee is required;

- fund arrangements with relation to a minor beneficiary’s interests;

- how many executors should I have.

Assets & Beneficiaries

You will need to identify your assets and the persons who shall receive your assets upon your death. It can be a piece of an heirloom jewelry that you inherited from your late grandfather or an apartment unit that you have recently purchased in the market. You will need to have legal ownership of that asset. The following are examples of assets:

Beneficiaries can also be charitable and religious organizations.

You may seek professional legal advice from us specifically on the following:

- Can I make gifts to my unborn child?

- Are CPF monies excluded from Wills?

- If I have 30% ownership in an apartment, how do I gift that portion?

- If my beneficiary has a HDB, can he/she inherit my house?

- Will my beneficiary/beneficiaries be subjected to inheritance tax in Singapore?

At Engelin Teh Practice LLC, we have an experienced and dedicated Estate Law team to assist you with the drafting of the Will. Drop us a message to know more, or you could drop us an email legal@etplaw.com.

- Our Expertise

-

Charmaine Lim, Associate

Wills and Probate

Our lawyers have extensive experience in drawing up wills and acting for our client in probate matters, including contested probate applications.

Do I need a will?

The attached video will explain in detail all you need to know about making a will.

Probate

Probate is a critical legal step needed before a person’s estate can be administered or distributed to the beneficiaries. It is a document issued by the court certifying the will is valid. It also confirms the appointment of an executor. There are two main types. Probate and Letters of Administration.

Why is probate needed?

A deceased person cannot continue to hold bank accounts, shares, real property, cash, superannuation or furniture. They can’t be employed or receive pension payments.

- Probate starts the process of winding up all their affairs.

- Probate makes the will legal

The court requires proof that the executor appointed in the will is alive, willing and competent to undertake the tasks involved. It determines the document is the last will made by the deceased. It also verifies that there are no objections to the will.

Why is probate important?

Without probate an executor does not have the authority to administer the estate. Without probate, an executor would not be able to transfer certain assets to beneficiaries.

What if there is no will?

When a person dies without a will, there is no executor appointed to administer the estate. In these cases, the next of kin usually have to apply for a document called ‘Letters of Administration’

What is Letters of Administration?

Letters of Administration is the court’s approval for someone to administer the estate of a person who dies without a will. In most instances this is granted to the next of kin of the deceased. This could be their spouse, their domestic partner or one of their children.

- References

-

Mark Yeo, Director

Handling of gaining control of the deceased foreign accounts (sept 2020)

Dear Paul,

How are you in this weird Covid time. Nothing is normal, but ETP succeeds in our mission.

Our last correspondence was in July 2019 and if I understand correctly, you have been following the progress in the background.

Last week, the Court finally granted the Letters of Administration.

I’d like to express my gratitude for your continued and invaluable guidance and the reduction in costs that was applied to us. Thank you so much.

We were faced with many obstacles as the process developed, with the issue of the executor and the applicability and interpretation of International law as ultimate lows. Mark Yeo, Justin Lim and ms Goh Siew Tin, the whole team have done a great job supporting me both legally and mentally. ETP has lived up to its motto “Service with the Heart”.

We would like to show our appreciation for ETP’s efforts in our case. However, due to the distance, we were never able to connect with Mark, Justin and ms. Goh Siew Tin. On the level to know their preferences for, for example, food and drinks. Delicacies (mooncakes or….. , alcoholic beverages (whiskey? Wine? Something else)

I can ask my brother Rick to arrange such on our behalf. Please let me know if you have any suggestions.

Warm regards,

Peggy de Haan-Gouw

September 2020

- Wills Drafting

-

Charmaine Lim, Associate

What is a Will?

A Will is a legal document that takes into effect only upon your death.

Contrary to popular belief, Wills are not only exclusive for the wealthy, but they are for everyone who has assets.

Upon your death, your executors shall bring the original copy of your Will to a lawyer to apply for a Grant of Probate.

Wills are revocable. So do not worry, if circumstances change, you can change your Will so long you have the requisite mental capacity to do so.

Benefits of drafting a Will

There are also many benefits to making a Will:

- To preserve the heritage we own in our lifetime, and to hand them to the rightful successors.

- To express your wishes on how certain properties are to be dealt with where the Intestate Succession Act is insufficient to fulfill such wish.

- To return monies that we have owed to persons who have helped us during difficult times.

- To express any intention to exclude categories of persons to be included in the Will.

The Importance of a Properly Drafted Will

A properly drafted Will will prevent your Estate from encountering complications later on, which could result in higher professional fees and time spent, and potentially impose unnecessary burden on your Executors. The common causes for poorly drafted Wills include:

- clauses that are incomplete;

- ambiguous words/terminologies used; or

- contradicting clauses

Drafting a Will with personalized attention by a qualified professional is very important. Our Wills are crafted by our lawyers, and they are customizable according to your needs and assets. There are certain clauses which clients intend to put in a Will could sometimes result in against the client’s wishes, if not properly advised.

What happens if I do not draft a Will?

Upon your death, the distribution of your Estate will be governed under the application for Grant of Letters of Administration. The assets will be distributed according to the hierarchy set out under the Intestate Succession Act. This means that the distribution of assets may not go according to your specific wishes if you have them.

Components of a Will

Wills can be simple (or complex) depending on the number of clauses and situations you wish to provide for. No matter how complex or simple a Will is, making a Will is akin to preparing a dish. There are the basic ingredients which give the Will its structure, and the absence of any of these basic ingredients can result in cost and time complications at the time of execution, or worse still, the Will to be rendered invalid. The key structure in a Will is outlined as follows:

Testator

We will need sufficient information about you. You must not be mentally impaired, and are able to make critical decisions for yourself.

You may seek professional legal advice specifically on the following:

- Can a foreigner draft a Will in Singapore?

- Can I have a joint-will with my spouse?

- Does a person with partial loss of mental capacity be totally precluded from making a Will?

Executor & Trustee

An Executor (Executrix for women), plays an important role in managing the Deceased’s Estate. When appointed, he/she will need to consult a lawyer to obtain a Grant of Probate. He/she is also entrusted to distribute the assets to the beneficiaries in a timely manner. Hence, the Testator will need to entrust these duties to an able and reliable person. It is also possible for the Executor (or Executrix) to be the beneficiary at the same time, and to also hold a position of a Trustee.

A Trustee has distinctly different duties from those of an Executor. Simply put, a trustee holds on trust the Deceased’s Estate for the beneficiaries. For instance, should there be a minor beneficiary named in the Will, then the Trustee will need to perform his duties to hold on trust the assets for the minor beneficiary until he / she becomes of age to own the assets in his/her own name. There are also professional trustees, who can provide such services to perform the role.

You may seek professional legal advice specifically on the following:

- when an independent trustee is required;

- fund arrangements with relation to a minor beneficiary’s interests;

- how many executors should I have.

Assets & Beneficiaries

You will need to identify your assets and the persons who shall receive your assets upon your death. It can be a piece of an heirloom jewelry that you inherited from your late grandfather or an apartment unit that you have recently purchased in the market. You will need to have legal ownership of that asset. The following are examples of assets:

Beneficiaries can also be charitable and religious organizations.

You may seek professional legal advice from us specifically on the following:

- Can I make gifts to my unborn child?

- Are CPF monies excluded from Wills?

- If I have 30% ownership in an apartment, how do I gift that portion?

- If my beneficiary has a HDB, can he/she inherit my house?

- Will my beneficiary/beneficiaries be subjected to inheritance tax in Singapore?

At Engelin Teh Practice LLC, we have an experienced and dedicated Estate Law team to assist you with the drafting of the Will. Drop us a message to know more, or you could drop us an email legal@etplaw.com.